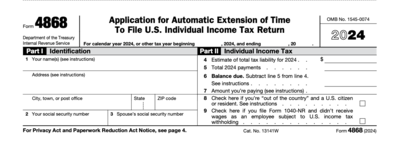

You also may have to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts ( FBAR), by June 30, 2016.ĭoes the IRS Provide Help in Other Languages? bank account may transfer funds from their foreign bank account directly to the IRS for payment of their tax liabilities. International taxpayers who do not have a U.S. affiliate that can help you make same-day wire transfers. bank account, ask if your financial institution has a U.S. bank account, you can use: EFTPS (Electronic Federal Tax Payment System), or Federal Tax Application (same-day wire transfer). You also can pay by phone using the Electronic Federal Tax Payment System or by a U.S. bank account using Direct Pay, the Electronic Federal Tax Payment System, or by a U.S. You can pay online with a direct transfer from your U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures Individual Income Tax ReturnĨ802, Application for United States Residency CertificateĨ938, Statement of Specified Foreign Financial Assetsġ4653, Certification by U.S. citizens and residents abroad)Ĥ868, Application for Automatic Extension of Time To File U.S. E-File options are listed on IRS.gov.Ģ350, Application for Extension of Time to File U.S.

#Irs e filing for 2016 tax extension free

Many Free File and e-file partners accept a foreign address.

#Irs e filing for 2016 tax extension software

Participating software companies make their products available through the IRS. You can prepare and e-file your income tax return, in many cases for free. A list of approved delivery services is available on IRS.gov You may use approved private delivery services. However, if you send a payment, separately or with your return, your payment is not considered received until the date of actual receipt. If you mail a return from outside the United States, the date of filing is the postmark date.

You can mail your tax return and payment using the postal service. Other extensions may be available on IRS.gov. Interest and penalties will generally be applied if payment make after this date. If you owe any taxes, you’re required to pay by April 18, 2016. Interest and penalties generally will be applied if payment is made after this date.Įxtension for all taxpayers to October 18, 2016: File Form 4868.Ĭaution: This extension applies only for filing your tax return, not for payment. No form is required write “Taxpayer Resident Abroad” at the top of your tax return.Ĭaution: This extension applies only for filing your tax return, not for payment.

Possible extensions of time to file tax return:Īutomatic extension to June 18, 2016, for taxpayers living outside the United States and Puerto Rico. If you live in Maine or Massachusetts, your federal tax return is due April 19, 2016, the day after the Patriots’ Day holiday in those states. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in Washington, D.C., - even if you do not live in the District of Columbia.

Generally, you must file a return if your gross income from worldwide sources is at least the amount shown for your filing status in the Filing Requirements table in Chapter 1 of Publication 54, Tax Guide for U.S. Your income, filing status, and age generally determine whether you must file an income tax return. income tax, regardless of where you reside. citizen or resident alien living or traveling outside the United States, you generally are required to file income tax returns, estate tax returns, and gift tax returns, and pay estimated tax in the same way as those residing in the United States. Cohen to present Letters of Credence to Governor General Mary Simon Cohen Following the Presentation of his Letters of Credence

0 kommentar(er)

0 kommentar(er)